New changes to Flood Insurance Rate Regulations started going into effect nationwide this year. The webpage from FEMA with the most information can be found here. They will affect all properties in the 100-year flood zone with subsidized/suppressed Flood Insurance Rates. The schedule of when they will kick in varies depending on whether a property is a primary residence, multi-family, commercial or a second home. They will not effect homes without flood insurance, though resale to anyone needing a mortgage would be affected.

The Borough of Lewisburg has many properties in the 100-year flood zone. Most have been grandfathered in at a lower flood insurance rates not reflective of actual flood risk.

The first requirement will be the acquisition of a Certificate of Elevation. A licensed surveyor will determine the elevation of the floors, including basements and crawlspaces, and specify the relationship between that and the Base Flood Elevation (BFE) in that location. Once that information is available, actual flood risk can be assessed and a target insurance rate established.

For primary residences, the change in rates will not go into effect until the insurance lapses or the property is sold, at which point, the new rates will be enforced in full. For other categories of property, there are timetables showing when the rate increases start to kick in and the schedule of increases set up until the full rate is reached. Some will start to take effect with the next annual renewal, with either a 10% or 25% increase. This will continue on annual renewals until the full rate is reached. Depending on how far below the BFE the Certificate of Elevation is, the rates may be very steep.

There continue to be questions and nuances to explore with this (such as what will the remapping scheduled for 2014 entail?). In the meantime, make sure you know where your property stands on the current Flood Insurance Rate Map (FIRM) and consult your insurance agent. Here is a way of accessing the FIRM online through Union County's GIS office. When you click the link on the page it takes you to the entire county. Use the navigation tools to zoom in on Lewisburg. You can adjust the type of basemap showing. And click "more" and check the "DFIRM Flood Maps" box to show the 100 year flood plain in great detail. The decision as to whether flood insurance is a requirement if any part of your property is in the floodplain or just some part of your structure is up to the insurance company.

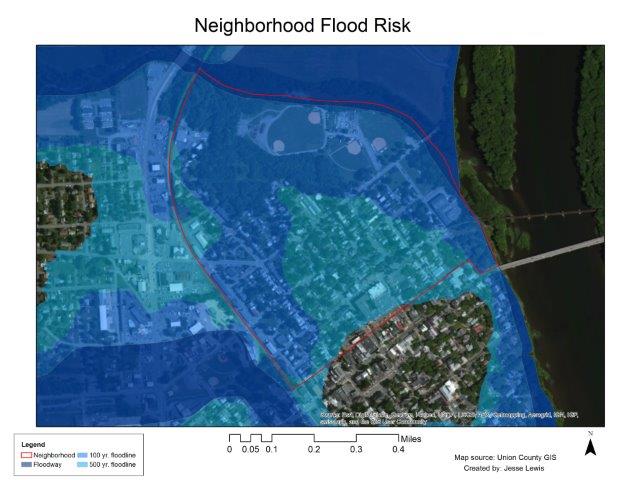

For general reference, here is the 100 and 500 year flood map for the North Ward Neighborhood. Bull Run Neighborhoods floodmap will be up soon. In this map the lighter blue area is the 500 year flood plain, the medium blue area is the 100 year flood plain and the darkest blue is the floodway. Areas not shaded are higher than the 500 year flood plain. The upper limit of the 100 year floodplain is somewhat below 34' above flood stage. You can also find information on various floodstage maps and historical flood elevations on the Borough website.

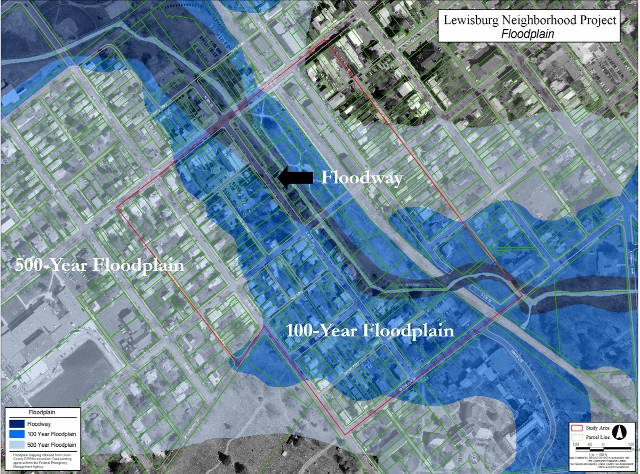

And here is a similar 100-year and 500-year floodplain map for the Bull Run Neighborhood. Please note that the colors/key for the two maps are different, though the delineated areas are similarly defined.

And here is a similar 100-year and 500-year floodplain map for the Bull Run Neighborhood. Please note that the colors/key for the two maps are different, though the delineated areas are similarly defined.